The Legal, Financial, and Ethical Risks of Manipulative Online Marketing

12/1/20254 min read

Ethical Online Marketing: What's Changing in 2026?

If you sell anything online in 2026, (coaching, consulting, digital products, programs, memberships, or services), ethical marketing is no longer just a “nice-to-have.” It is now a legal risk issue, a brand trust issue, and a platform survival issue.

Pressure selling, fake scarcity, emotional manipulation, and ND-shaming tactics are increasingly being scrutinized by regulators, payment processors, platforms, and consumers worldwide. Brands built on coercion are collapsing faster than ever. The businesses that are growing? They are the ones built on transparency, informed consent, and psychological safety. They are the businesses that were approved to be in the Neurovetted Directory of Ethical Online Service Providers.

Why Ethical Marketing Is Now a Business Survival Requirement

Short-term conversion spikes created through pressure tactics look impressive on spreadsheets. But the long-term fallout shows up as:

Elevated refund rates

Escalating chargebacks

Payment processor scrutiny

Loss of platform privileges

Public reputation damage

Legal exposure

These outcomes are no longer rare. They are predictable consequences of extraction-based marketing models.

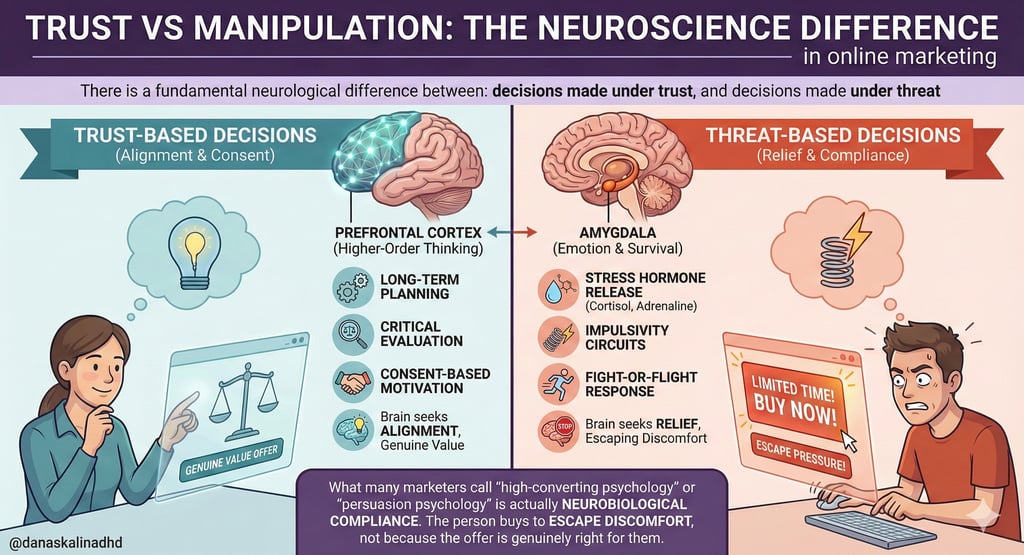

According to neuroscience, decisions made under psychological pressure activate threat and survival circuits in the brain rather than reflective reasoning (Arnsten, 2009; Phelps & LeDoux, 2005; Kahneman, 2011). Buyers are not choosing alignment, they are selecting temporary relief from emotional discomfort.

That distinction matters because threat-based buying reliably creates post-purchase regret, resentment, and refund behavior. Ethical marketing keeps the thinking brain online. Manipulative marketing intentionally shuts it down. And regulators are catching up.

The Global Legal Shift Toward Ethical Online Marketing

Most online business owners assume marketing ethics are subjective. They are not. Across multiple regions, ethical standards are now being codified into consumer protection law, privacy law, and deceptive marketing enforcement. Here is what every service provider must understand in 2026:

Canada: Competition Bureau + Anti-Deceptive Marketing Laws

Under the Competition Act, Canadian businesses are prohibited from:

False urgency

Misleading “limited availability” claims

Deceptive pricing

Exaggerated outcome claims

If you use fake countdown timers, manipulate waitlists, or claim “last chance” without verifiable proof, you may be violating federal law. Additionally, emotional deception that distorts a consumer’s ability to make an informed choice can trigger enforcement.

United States: FTC + INFORM Consumers Act

The Federal Trade Commission now aggressively enforces:

Deceptive advertising

False scarcity claims

Undisclosed testimonials

Emotional manipulation in vulnerable populations

The INFORM Consumers Act also requires truthful business disclosures, especially in digital commerce. Businesses are being fined, delisted, and permanently banned from payment processors for unethical marketing patterns — not isolated incidents.

United Kingdom: GDPR + Consumer Protection from Unfair Trading Regulations

In the UK, consumer consent must be:

Freely given

Fully informed

Not emotionally coerced

The Consumer Protection from Unfair Trading Regulations (CPRs) explicitly prohibit:

Aggressive commercial practices

High-pressure sales tactics

Misleading urgency

Emotional manipulation now qualifies as undue influence, a legally recognized coercive practice.

Australia: Australian Consumer Law (ACL)

Under ACL, businesses must not:

Make false or misleading representations

Create artificial urgency

Use deceptive psychological persuasion

Australian regulators routinely issue six-figure penalties for deceptive digital advertising and pressure-based conversion funnels.

New Zealand’s Fair Trading Act prohibits:

Misleading representations

Unsubstantiated urgency

Pressure-based selling that interferes with informed choice

Digital marketers operating internationally are often unaware they are legally accountable under multiple consumer protection frameworks at once.

Global Reality: You Are Regulated Where Your Clients Live

If you sell to international clients, you are subject to:

Their jurisdiction’s consumer law

Their privacy and consent standards

Their deceptive marketing enforcement rules

Ethical marketing is no longer optional when your audience is global (OECD, 2016/2023; FTC US SAFE WEB Act; GDPR Article 3; Competition Bureau Canada; ACCC Australia; UK CMA; NZ Commerce Commission). Cross-border consumer protection law consistently holds that businesses are regulated based on the location of their clients, not just where the business operates

Why These Tactics Are Especially Harmful to Neurodivergent Buyers

Neurodivergent clients experience structural vulnerability to:

Impulsivity

Rejection sensitivity

Emotional dysregulation

Time blindness

Decision fatigue

Pressure tactics, guilt-based selling, scarcity manipulation, and ND-shaming exploit these neurological realities. What is framed as “conversion psychology” in marketing culture is often neurological compliance under emotional threat (Arnsten, 2009; Tangney et al., 2007; Kahneman & Tversky, 1979; Cialdini, 2009; Barkley, 2015).

This is why Neurovetted™ explicitly classifies the following as prohibited tactics:

Fake countdown timers

“Last chance to fix your life” framing

Manufactured urgency

Shame-based messaging

Weaponizing ADHD and autism traits to provoke buying

These tactics do not increase empowerment. They increase harm.

What Ethical Online Marketing Actually Looks Like

Ethical marketing is not passive. It is structurally designed for informed consent. True ethical marketing includes:

Clear visible pricing

Transparent refund policies

Honest outcome framing

Accurate scope of service

Absence of manufactured urgency

Respect for financial boundaries

Ethical conversion does not rush, corner, shame, or emotionally leverage the buyer. It creates conditions where thoughtful evaluation is possible. Aligned clients stay longer, refer more often, create fewer disputes, and generate sustainable revenue. Coerced clients burn brands down (Reichheld & Sasser, 1990; Anderson & Sullivan, 1993; Tripp & Grégoire, 2011).

The Hidden Operational Risk in Manipulative Funnels

Many brands assume legality is the only concern. It is not. Manipulation also triggers:

Platform bans

Stripe and PayPal account closures

Chargeback monitoring flags

Payment reserve holds

Marketplace removal

Public consumer warnings

Once payment processors classify your business as “high risk,” recovery is extremely difficult.

For example, Visa explicitly confirms that in the in the Visa Chargeback Monitoring Program (VCMP) high dispute ratios trigger:

Monitoring programs

Financial penalties

Mandatory remediation

Possible termination of processing privileges

Once a merchant is placed in either the "High Risk", or "Excessive" Programs, removal is:

Time-bound

Conditional

Not guaranteed

Often followed by continued rolling reserves or account termination

Stripe also explicitly states that accounts classified as high risk may be:

Immediately terminated

Placed in rolling reserves

Denied reactivation

And Stripe is not obligated to reinstate terminated accounts. Bottom Line? Ethics, in 2026, is not just moral. It is operational risk management.

The Line the Online Industry Is No Longer Allowed to Cross

If your revenue depends on:

Rushing people

Shaming hesitation

Threatening missed opportunity

Triggering desperation

Creating false scarcity

Exploiting vulnerability

You do not have a marketing system. You have a compliance machine.

Neurovetted.com was created to define and uphold a clear boundary between ethical marketing and coercive conversion practices. Trust is now the only stable currency left.

Do Not Enter 2026 With Exposed Marketing Practices

If you are still using pressure, urgency, or emotional leverage to sell, 2026 is not going to be kind to your business. Regulation is tightening. Payment processors are watching. Consumer complaints are accelerating.

If your marketing has never been formally audited for ethical and regulatory risk, you are operating blind. You need to have an audit done today!

info@neurovetted.com

Copyright 2026

Neurovetted is a public directory only. Providers are independent businesses. Neurovetted does not guarantee services, outcomes, or results and is not responsible for transactions or disputes between users and providers.